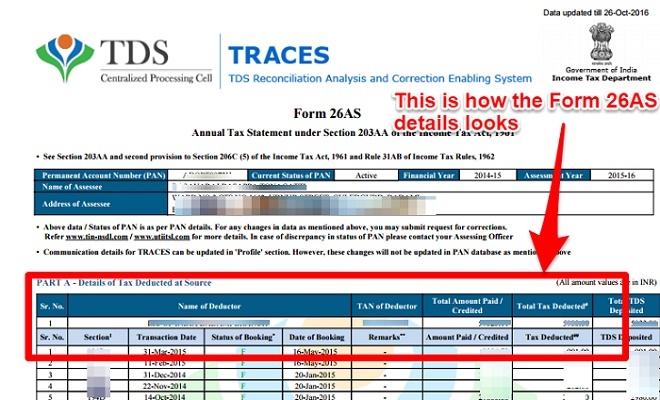

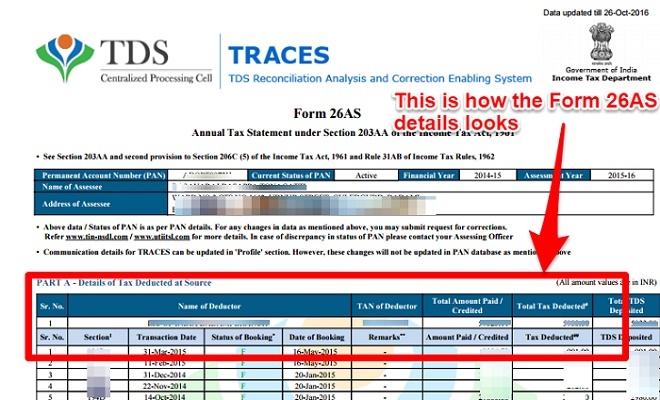

This amount is deducted at source and submitted by the deductor into your PAN number and the tax department will mention the same amount in Form 26AS part A as mentioned in the red box below.

Part A of Form 26AS reveals the details of tax deduction at source like from your salary, interest received from the bank, pension income, etc. How to interpret form 26as? – The Step by Step section-wise explanation~ Details of Tax deducted at source – Part A Whats why the term derived from “Tax deducted at source”. Tax deducted at source (TDS) is the tax amount deducted at the beginning of the transaction means, the person making payment to the other will deduct the TDS amount of the person and deposit into the PAN number of the person.

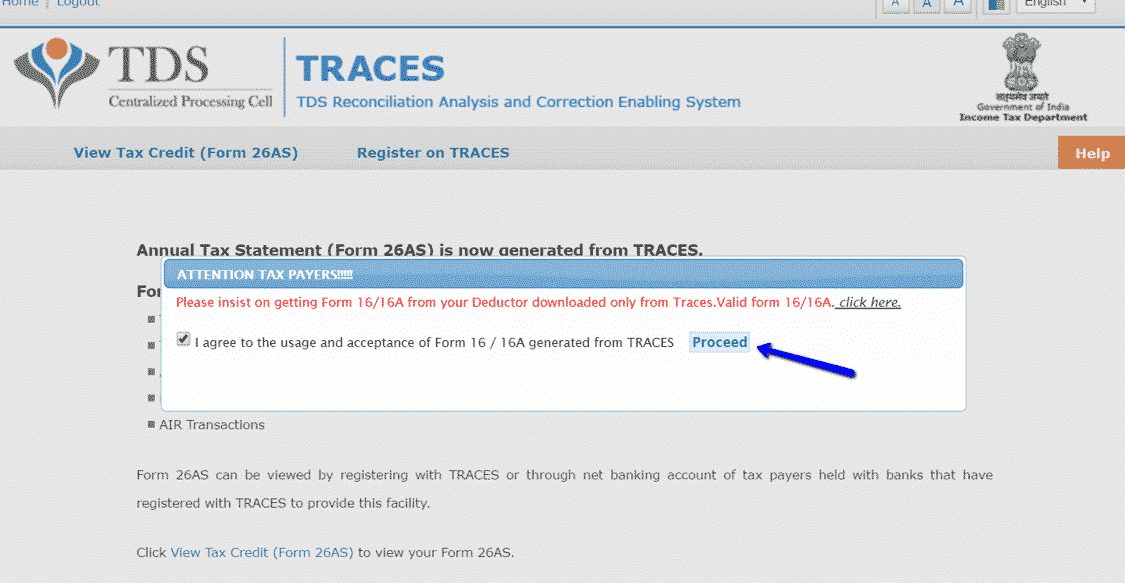

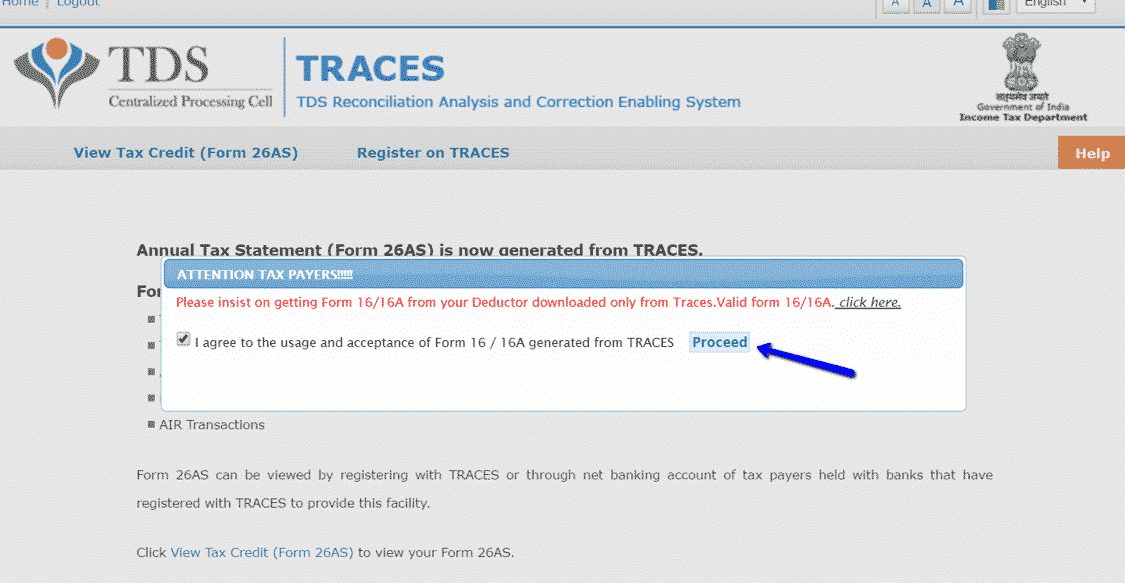

Part G – TDS Defaults (Processing of statement)īefore diving into the details of the above section, it is very important to clarify one thing: What is Tax deducted at source. Part F – Details of Tax deducted at source on sale of immovable property u/s 194IA/TDS on rent pf property u/s 194IB (for buyer/tenant of property). Part C – Details of Tax paid (other than TDS or TCS). Part B – Details of Tax collected at source. Part A2 – Details of Tax deduction at source on sale of immovable property u/s 194IA/TDS on rent pf property u/s 194IB (for seller /landlord of property). Part A1 – Details of Tax deduction at source for 15G/15H. Part A – Details of Tax deducted at source. 26as form detailsįorm 26AS provides the taxpayer information in following different parts: In this analysis of this article, you will self-confidently examine your own form and get rid of problems. It is very easy to view form 26as by pan no just by log into income tax websiteĪfter login, you will get the complete form with a lot of information bifurcated into several parts, each part consisting of different information. In any variation, you are welcome to get the income tax notice.Īlso Read: Shares Fundamental Analysis (Complete Guide) The IT department also tallies all your tax deduction details provided by you by Form 26AS. Income Tax department keeps all your tax-related data in their database through 26AS. What to do if your TDS is not deposited with the government?įorm 26AS is a consolidated tax deduction statement, which keeps all your annual record of any tax paid by you or on your behalf. How many days it takes to reflect in form 26as. How to check form 26as without registration. How to access Form 26AS + How to download form 26as from traces. TDS Defaults (Processing of statement) – Part G. Details of Tax deducted at source on sale of immovable property – Part F. Details of Tax Paid (other than TDS or TCS) – Part C.

Details of Tax collected at source – Part B.Details of Tax deduction at source on sale of Immovable property – Part A2.Details of Tax deduction at source for 15G/15H – Part A1.Details of Tax deducted at source – Part A.

0 kommentar(er)

0 kommentar(er)